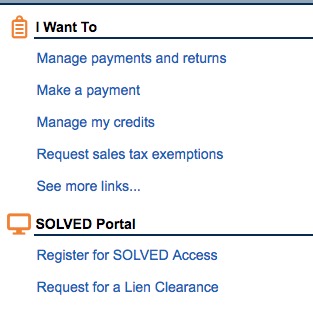

Feb. 2018. It seems to me there isn’t anything specific out there to tell you how to get a Georgia Sales and Use taxes. I need one because I want to sell a product online and at craft fairs in the state I live in. I went ahead and signed up with the GA Tax Center first for my personal taxes. Georgia Tax Center I visited their site registered for my personal taxes. I registered for a sole proprietorship. Now if you are already a LLC or Incorporated then this won’t apply to you. After I set up my personal tax login I went ahead and applied for a sole proprietorship. There is a section on the page after you login that says “see more links”.

Then once that clears. You’ll see it under your submission section. Then you go back to “see more links” again. This time you will select 4th from the top. Register a New Tax Account. Follow the directions. You need to know the your North American Industry Classification System (NAICS). There is a search field that you can type in some keywords and I was able to find mine. That was the hardest part. Then I answered the questions. It was pretty easy. Free.

The Sale and Use tax I can pay online with my account on a monthly basis. I have to report even if I don’t make any money at all that month. I’m going to call the GA Tax Center incase I have any issues. Super nice people on the phone. Don’t be afraid to call.

After that I went to my County Business Registration office and applied for my business license. The cost was on a sliding scale. Depends on how much you think you will make per year. They helped me out at the office to fill it out. Then each year I will have to repay the fee.

It had always seemed like a mystery how all this worked. It isn’t too bad. I asked lots of questions from the different offices.

They never make it easy.

LikeLiked by 1 person

So true! I have to post every month even if I did zero.

LikeLike